Fixed-income markets are awash in news of the increasing number of sovereign debt issues coming to market with negative nominal yields. The question is how low can yields go?

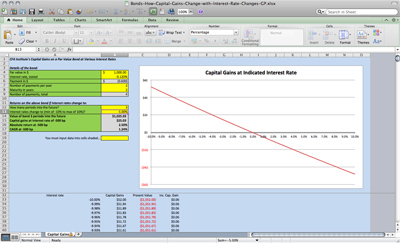

In order to help answer the question we created a spreadsheet that helps to demonstrate and evaluate the strategy behind purchasing a negative nominal yield debt instrument. (Feel free to download and play with the spreadsheet. Please see the instructions for use in the postscript.) Take the recently priced two-year maturity −0.12% German Schatz. On the surface, purchasing this instrument seems very peculiar and raises the question, “Why would anyone purchase a negative nominal yield bond?” After all, to purchase such a bond effectively means that you are paying the issuer to safeguard your capital until maturity. Why not just convert your money to cash and stash it in a safe-deposit box instead?

Yet when we look at the spreadsheet, we can see that a compelling argument, not unique to the fixed-income world (see below), can be made for purchasing negative nominal yield securities. This is due to the possibility of interest rates going even lower/capital gains rising even higher. Obviously, this is a greater fool/musical chairs game. The game nears its end with the relentless march toward maturity when the music finally stops. But, up until the very last trading day prior to maturity, there is still the possibility of making money in a negative nominal yield bond if the change in market yields (i.e., they still go negative further) compensates you for your cost of capital.

Of course, what this means is that the income component of investing in sovereign fixed income is now almost meaningless; what really matters is the gamble on the shape of the future yield curve and the credit quality of the issuer. If you can accurately forecast the future yield curve — and in the United States, the Federal Reserve now telegraphs its intentions — you can still make money in a negative nominal yield world. You just have to hope that the rates keep getting lower after you have purchased your bond.

While this is a whole new world in the fixed-income space, effectively this strategy is no different than U.S. equity investors who from September 1965 to December 2007, on average, purchased stocks with negative equity risk premiums (−0.91%; source: CFA Institute). Put another way, earnings yields (the inverse of the P/E ratio) relative to sovereign debt yields were persistently negative. Interpretation: Earnings yields didn’t matter; what mattered were capital gains. Sound familiar? That is, equity investors’ only hope for outperforming sovereign debt was if prices would be higher, net of transaction costs, at some point after they bought their stocks. As we know that assumption persisted intermittently for more than 42 years. Could the bond market stay in a negative yield situation for 42 years? Who knows, but these are indeed strange times.

One final point about the risk of investing in a negative nominal yield security: In the equity arena maturities are perpetual, but in the fixed-income space maturities are certain and fixed. This makes “investing” in negative nominal debt yields a potentially more dangerous activity, because the music will play for only so long.

Click here to download the spreadsheet: Bonds: How Capital Gains Change with Interest Rate Changes, GP

Instructions for using spreadsheet:

- Cells shaded in yellow are for inputting data.

- Inputs are in two sections: upper section, or bond details; and lower section, or scenario details.

- For the bond details section you will need to provide the:

- Par value of the debt instrument

- Nominal interest rate

- Number of payments per year

- Maturity in years

- For the scenario details section you will need to provide the:

- Number of periods into the future you want to examine

- Your interest rate assumption for that future period

Note: the graph clearly demonstrates the duration and convexity of a bond issue given changes in both time to maturity and interest rates. This feature of the spreadsheet alone is instructive.

Robert Gowen, CFA, Dave Larrabee, CFA, and Ron Rimkus, CFA, contributed to this article.

Business chart illustration from Shutterstock.

Originally published on CFA Institute’s Enterprising Investor.

0 Comments