MODELERS OF ALL MARKETS, UNITE! You have nothing to lose but your illusions.

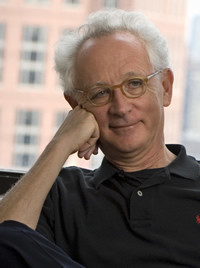

–Dr. Emanuel Derman

Nobody personifies a “quant” like Emanuel Derman. First, there is his educational pedigree: After earning a PhD in theoretical particle physics from Columbia University, he conducted research at the University of Pennsylvania, Oxford University, Rockefeller University, and the University of Colorado, Boulder. Next, his practitioner pedigree: AT&T Bell Laboratories; Goldman Sachs & Co.; Salomon Brothers; and now Prisma Capital Partners. Along the way he has invented important equations (Black-Derman-Toy interest rate model); authored numerous critical papers and several books; and won numerous awards (IAFE/Sungard Financial Engineer of the Year, 2000; Risk Hall of Fame, 2002 inductee).

But it is his latest work, Models.Behaving.Badly, that is particularly instructive in the wake of the 2008 global financial crisis and subsequent Great Recession — and will be the central focus of his upcoming presentation at the CFA Institute Financial Analysts Seminar on 24 July 2012 in Chicago.

In the book, Derman smartly draws distinctions between three primary ways of describing the world:

- Theories. Derman says theories are attempts to describe the world absolutely, not relatively. That is, they attempt to discover the principles that drive the world, and they need confirmation. He states that theories must describe and deal with the world on its own terms. Theories tell you what something is.

- Models. By contrast, he describes models as analogies that compare something you do understand with something that you would like to understand. In other words, Emanuel Derman feels that models, in requiring a comparison, are relatively based, not absolutely based. Models resemble something else, and that resemblance is always partial. Models tell you what something is like.

- Intuitions. Last, Derman discusses intuitions, which he says are the deepest form of knowledge, but notes that these “Eureka!” moments come only after much hard work in which the understander merges with the understood. He provides an analogy to explain: intuition merges the archer with the bow.

Knowing the strengths and limitations of these modes of interacting with the world is essential if one is to successfully describe the world quantitatively. Given the subject of his discussion at the Financial Analysts Seminar, “The World is NOT a Model,” it seems certain that he will be providing attendees with not just a road map for quant success but also a guide to its obstacles.

Consider, for example, the fact that in Models.Behaving.Badly, Derman, together with Paul Wilmott, boldly proposes “The Financial Modelers’ Manifesto.” This manifesto concludes with “The Modelers’ Hippocratic Oath”:

I will remember that I didn’t make the world, and it doesn’t satisfy my equations.

Though I will use the models I or others create to boldly estimate value, I will always look over my shoulder and never forget that the model is not the world.

I will not be overly impressed by mathematics. I will never sacrifice reality for elegance without explaining to its end users why I have done so.

I will not give the people who use my models false comfort about their accuracy. I will make the assumptions and oversights explicit to all who use them.

I understand that my work may have enormous effects on society and the economy, many beyond my apprehension.

Boldest of all, Derman fearlessly states that analysts have nothing to lose but their illusions in adopting this credo.

Originally published on CFA Institute’s Enterprising Investor.

0 Comments