I strive to be smart, wise, analytical, creative, intuitive, and informative. I hope to help make you a better active investment management pro.

I recommend you start with the Best of the Blog.

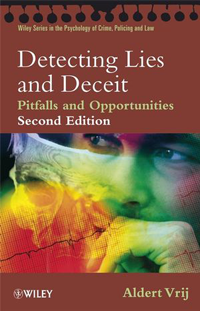

Lie Detection 101 for Financial Analysts: How to Spot Manipulators and Actors

Financial analysts are in the business of evaluating the truth of information. But there is a shocking lack of academic research about how financial analysts can improve their lie and deception detection skills even though the monetary stakes are measured in trillions (choose your currency). We hope to remedy this situation by covering the topic of lie detection regularly on this blog. For my inaugural piece on the topic, read “Lie Detection: How Can Financial Analysts Improve Their Ability to Discern the Truth?” What follows below in this...

read moreCapitalism: It’s as Much About Cooperation as Competition

We have myopically come to believe that “survival of the fittest” is synonymous with competition and is the highest expression of our nature. Yet survival of the fittest also includes those creatures, including humans, who successfully and continuously cooperate to survive. Case in point: Lions adorn the flags of many nations as symbols of individual power and unparalleled ferocity — think of King Richard I of England, who was, after all, called Richard the Lionheart. But as we all know, lions actually hunt and cooperate in packs...

read moreUnderstanding the LIBOR Scandal: Recommended Reading

The scandal surrounding LIBOR, the London Interbank Offered Rate, continues to sweep through global finance — so much information, so little time for investment professionals to assess the facts. Lost in the scandal discussion the last several years are the invisible costs of numerous investment professionals that used LIBOR as the basis of their costs of capital and all of the decisions made based on a faked rate. Ouch! Here are some recommended reads to help you home in on the essentials of this still-unfolding imbroglio concerning the...

read moreIntuitive Investor Simple Basics and Power Principles Course at en*theos Academy

Hi! Many of you over the years have asked me to teach the material in my award winning book The Intuitive Investor: A Radical Guide for Manifesting Wealth. I am therefore very pleased to announce my forthcoming course Intuitive Investor Simple Basics and Power Principles offered with my pals at the en*theos Academy! The course is designed for investors of any proficiency and will be taught LIVE each Sunday 5 August thru 26 August at 10am PDT/1pm EDT. The more creative and intuitive you are the better. The Intuitive Investor is a book...

read moreFinancial Engineers Behaving Boldly: Emanuel Derman

MODELERS OF ALL MARKETS, UNITE! You have nothing to lose but your illusions. –Dr. Emanuel Derman Nobody personifies a “quant” like Emanuel Derman. First, there is his educational pedigree: After earning a PhD in theoretical particle physics from Columbia University, he conducted research at the University of Pennsylvania, Oxford University, Rockefeller University, and the University of Colorado, Boulder. Next, his practitioner pedigree: AT&T Bell Laboratories; Goldman Sachs & Co.; Salomon Brothers; and now Prisma Capital...

read moreNegative Nominal Debt Yields: How Low Can Yields Go?

Fixed-income markets are awash in news of the increasing number of sovereign debt issues coming to market with negative nominal yields. The question is how low can yields go? In order to help answer the question we created a spreadsheet that helps to demonstrate and evaluate the strategy behind purchasing a negative nominal yield debt instrument. (Feel free to download and play with the spreadsheet. Please see the instructions for use in the postscript.) Take the recently priced two-year maturity −0.12% German Schatz. On the surface,...

read moreHoles in Some of Finance’s Critical Assumptions: A Dialogue with Massif Partners’ Kevin Harney (Part Two)

In part one of “Holes in Some of Finance’s Critical Assumptions,” Kevin Harney of the hedge fund Massif Partners discussed some of the market distortions arising from critical finance assumptions like Brownian motion and normal distributions used in options pricing. What are some of the effects of these choices? What can be done differently? Here is what Harney said. Jason Voss: If I may interrupt you there for a moment. . . . You just said something, in passing, that is, to me, rather profound, and I want to make sure that I have this right....

read more29 May 2012: I was on the floor of the NYSE for the first time!

Jason Apollo Voss, CFA and his first trip to the floor of the New York Stock Exchange (NYSE).

read moreHoles in Some of Finance’s Critical Assumptions: A Dialogue with Massif Partners’ Kevin Harney (Part One)

In finance even basic assumptions — like which technique to use to calculate prices for such financial instruments as derivatives or how you calculate rates of return for assets — determine how you see the world. If the techniques have flaws, then your understanding and insight into things as fundamental as prices and return are also flawed. Chief among the flaws are Brownian motion used as a proxy of random movement, its use in calculating compound annual growth rates, and the valuation sensitivity of derivative instruments to volatility....

read more17 May 2012: Link to Jason Apollo Voss’ Nationwide (UK) Interview with the BBC’s Today Programme

Today Jason Apollo Voss, author of The Intuitive Investor was privileged to be interviewed by Simon Jack of the BBC’s #1 ranked radio show, the Today programme. The subject was Facebook’s (ticker symbol: FB) initial public offering (IPO). Thanks very much to Mr. Jack and the Today Programme! It was a treat to be broadcast to approximately 10% of the UK population!

read more