by Jason Apollo Voss | 30 08 2022 | Blog, DATA

At Deception And Truth Analysis (D.A.T.A.) we are first and foremost, grounded in the findings of deception science. Globally there are just a handful of researchers working in this space. Here we are talking about endowed professorships, or researchers whose sole...

by Jason Apollo Voss | 25 08 2022 | Blog, DATA

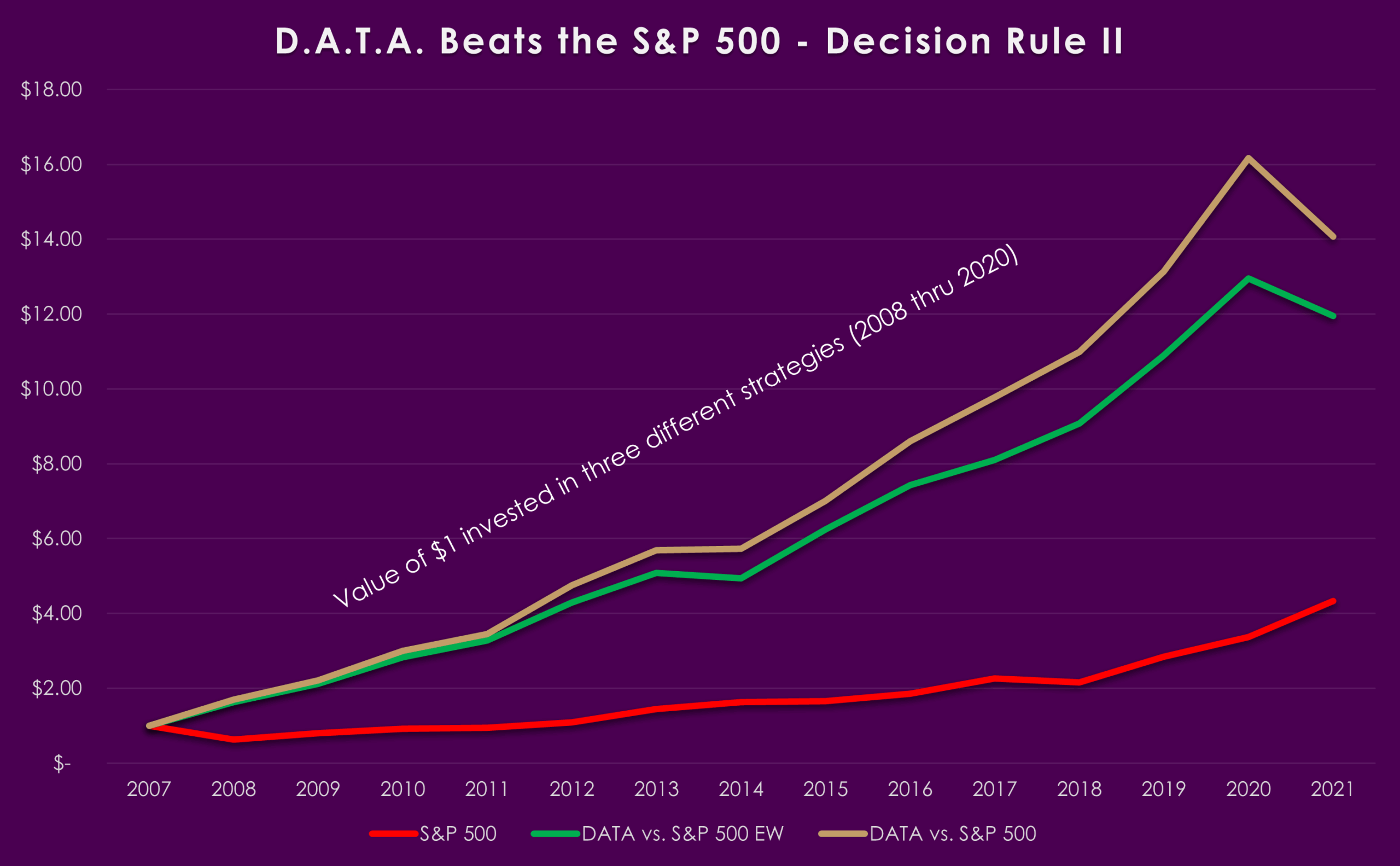

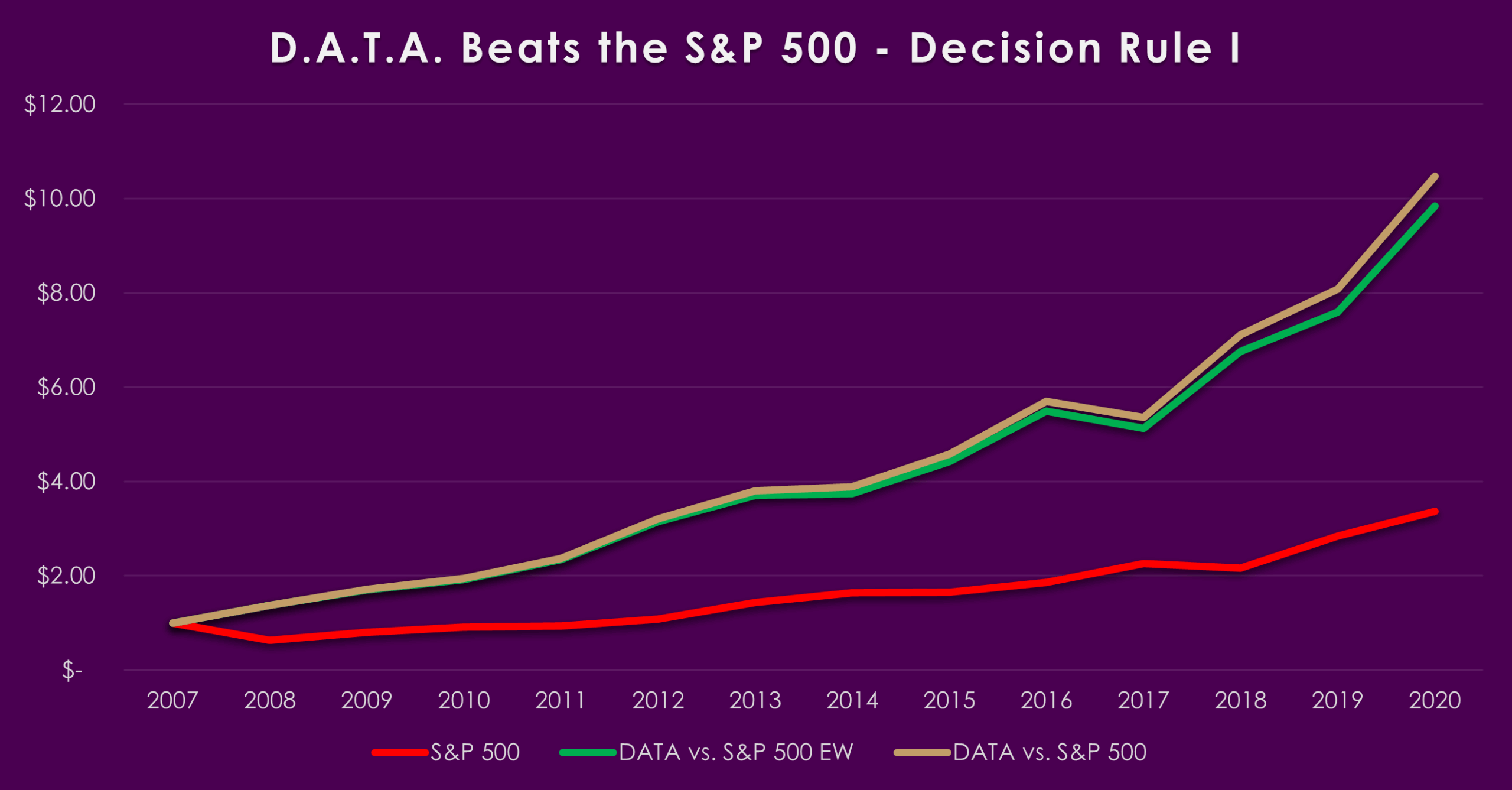

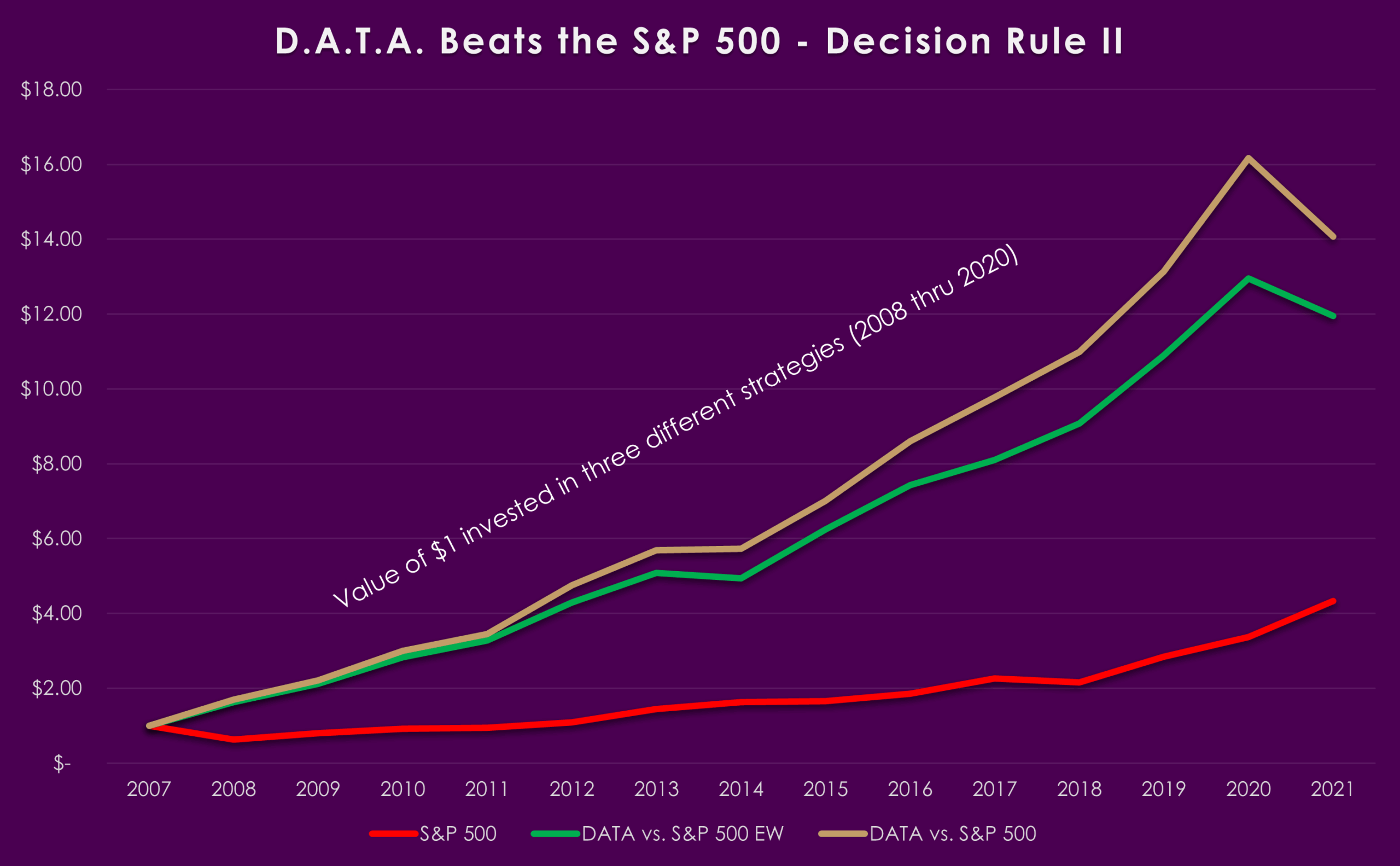

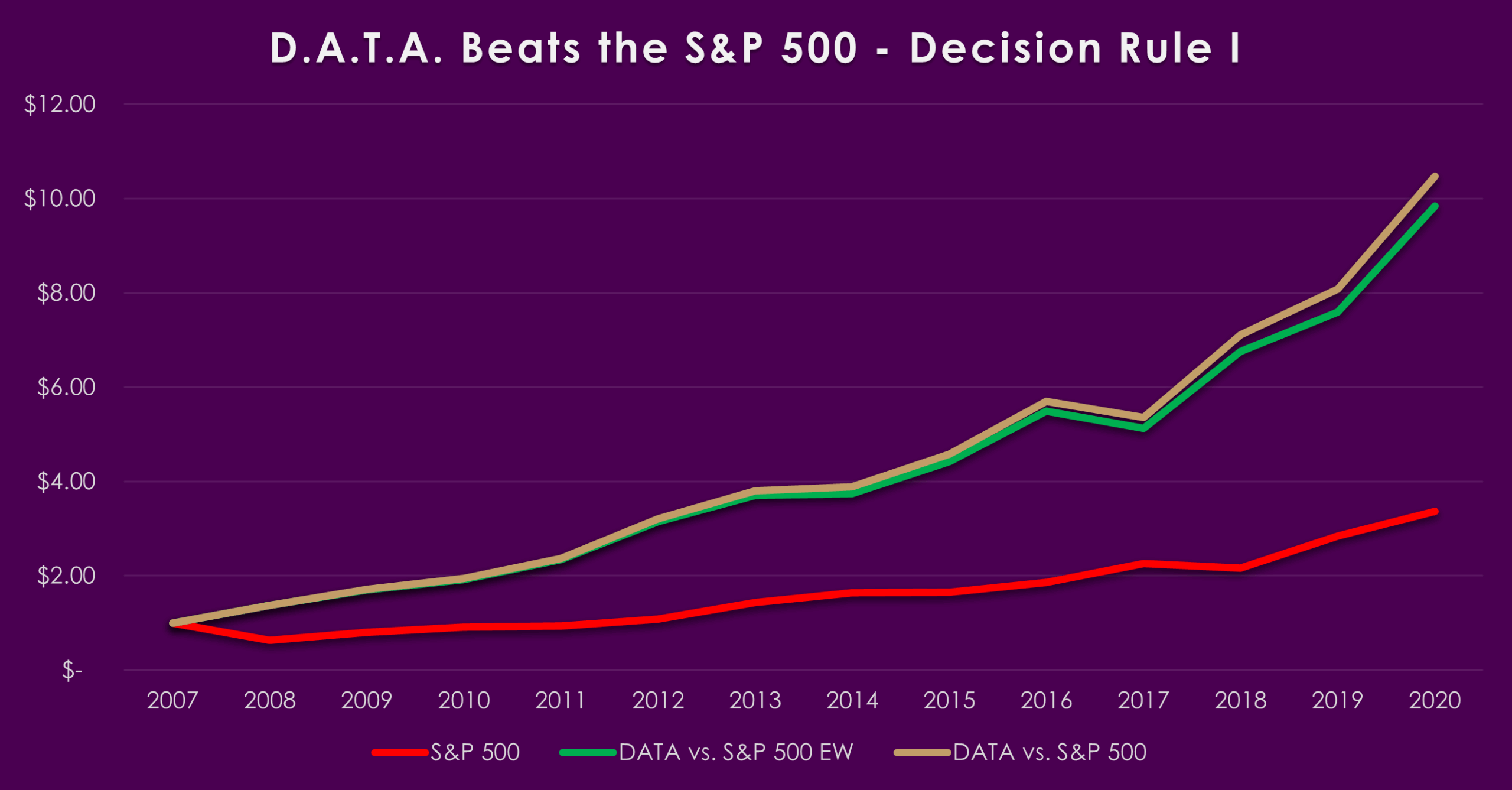

Deception And Truth Analysis (D.A.T.A.), Inc. has spent almost a decade working with deception scientists[1]and studying multiple methods of deception and truth detection. Based on this knowledge we developed Deception And Truth Analysis, a proprietary algorithm based...

by Jason Apollo Voss | 24 08 2022 | Blog, DATA

Deception And Truth Analysis (D.A.T.A.), Inc. has spent almost a decade working with deception scientists[1]and studying multiple methods of deception and truth detection. Based on this knowledge we developed Deception And Truth Analysis, a proprietary algorithm based...

by Jason Apollo Voss | 23 08 2022 | Blog, DATA

The We Company, more popularly known as WeWork, is now a public company. But you may remember that it yanked its original attempted IPO on 30 September 2019 among many investor concerns.[i]For us at Deception And Truth Analysis (D.A.T.A.) this makes for an interesting...

by Jason Apollo Voss | 16 08 2022 | Blog, DATA

Wirecard is an especially interesting use case for investors wanting to protect themselves against deception. This is because Wirecard was largely a private market investment where there was: Little audited financial data, unlike public markets There was less...

by Jason Apollo Voss | 09 08 2022 | Blog, DATA

Last week in our article entitled, “Financial Professionals’ Beliefs about Deception,” we reviewed our scientific paper, “Detecting Lies in the Financial Industry – A Survey of Investment Professionals’ Beliefs,” published in the Journal of Behavioral Finance. This...