Fact File: S&P 500 Volume Data

Posted by Jason Apollo Voss on May 2, 2012 in Blog | 0 commentsWhen analyzing long swathes of market history, commentators usually focus on changes in price or price-to-earnings ratios of the Standard & Poor 500. Trading volume data, however, are infrequently discussed. Yet there are many interesting facts to be gleaned from just a simple analysis of historical S&P 500 volume.

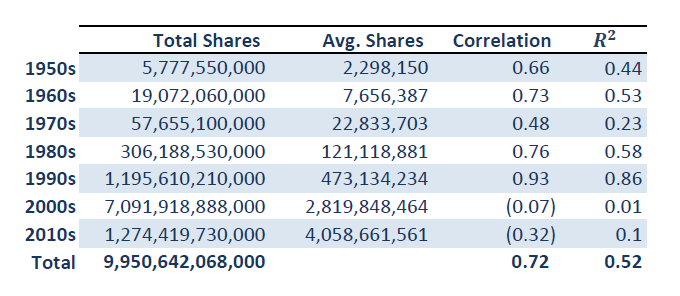

S&P 500 Historical Volume Data (2 Jan. 1951 – 31 Mar. 2012)

Sources: Yahoo Finance, CFA Institute.

The Take-Aways:

- The busiest trading day ever for the S&P 500 was 10 October 2008, when a phenomenal 11,456,230,400 shares changed hands. Amazingly, this volume was almost double the trading volume for the entire decade of the 1950s!

- The slowest trading day ever for the S&P 500 was Christmas Eve day 1951, when a paltry 680,000 were bought and sold.

- As you can see in the table above, the total number of shares traded per decade for the S&P 500 has grown tremendously, from total shares of 5.78 billion traded in the 1950s to 7.1 trillion traded in the 2000s. The 7.1 trillion shares traded in the 2000s is 347.6% larger than the combined total of the preceding five decades.

- The average shares traded per day for the S&P 500 has grown from 2.3 million to 4.1 billion. To better grasp this, it is as if Pluto’s diameter rapidly grew to twice the diameter of the Sun!

- Total growth in average shares traded per day for the S&P 500 is a staggering 176,505.6%! This is a strong argument for being in the commissions business.

- Correlation between trading volumes and prices peaked in the decade of the 1990s at 92.8%. This means that as trading volumes went up from the 1950s through the end of the year 2000, so did prices. But since then, the correlation between S&P 500 trading volume and prices has been negative. Put another way, as volumes have gone up, prices have declined. This strikes me as very strong evidence of a slow, snarling bear market.

Stock index dynamics illustration from Shutterstock.

Originally published on CFA Institute’s Enterprising Investor.