The Decline in Stock Listings Is Worse than You Think

Posted by Jason Apollo Voss on Sep 30, 2013 in Best of the Blog, Blog | 0 commentsThe decline in stock listings in the United States has been well documented by industry professionals and the media alike. Based on my own calculations, though, commentators seem to be missing a larger and potentially more alarming story: Equity listings worldwide, not just in the United States, have dropped precipitously. The data thus fly in the face of a bedrock belief about capitalism and free markets: that one of the strengths is the ease with which new enterprises can fund themselves through public equity listings.

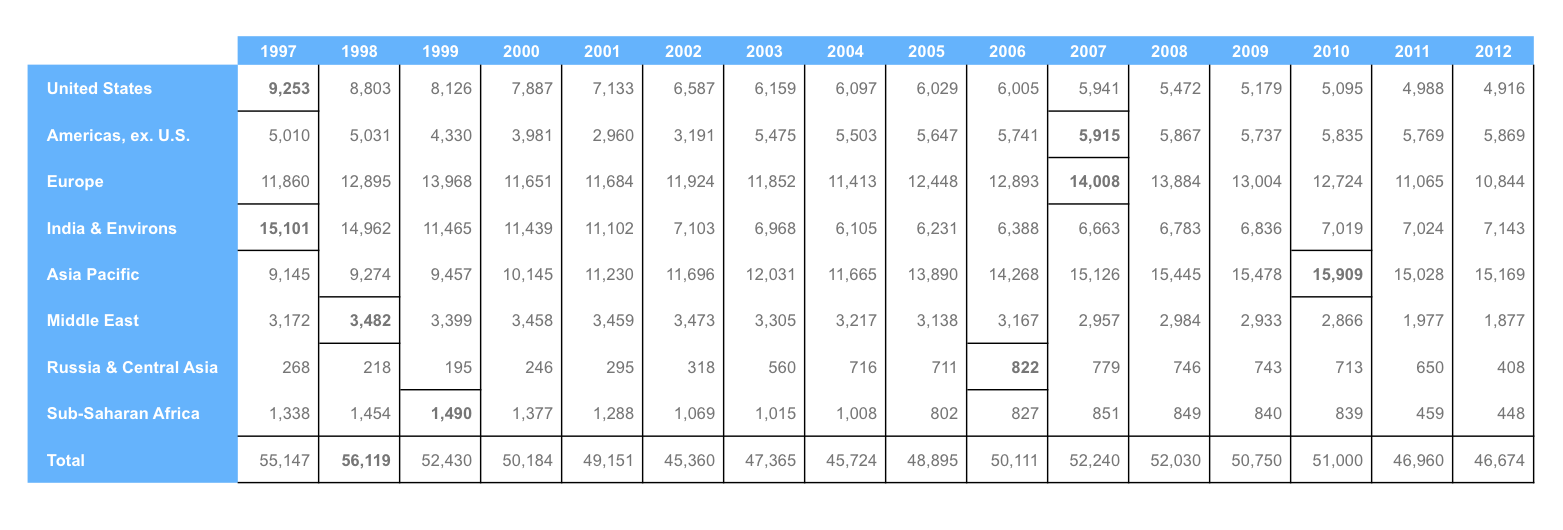

Threading the numbers together takes a bit of work. Based on data covering 142 stock exchanges since 1975 that I compiled from multiple sources, including the World Federation of Exchanges, University of Houston, University of Virginia, Journal of Finance, and CFA Institute, I estimate that the number of global stock listings is down by 16.8% since peaking in 1998. More specifically, the number of global equity listings stood at just 46,674 at the end of 2012 after peaking at 56,119 in 1998.

The data show that equity listings have declined in every major region, including the United States, Europe, and Asia Pacific:

- In the United States, total stock listings peaked at 9,253 in 1997 and declined to a paltry 4,916 at the end of 2012 — down by an astonishing 46.9%!

- Europe’s equity listings peaked in 2007 at 14,008 and stood at 10,844 at the close of 2012 — a decline of 22.6%.

- In the Asia-Pacific region (including Australia), equity listings have only fallen 4.7% to 15,169 from a 2010 peak of 15,909. Yet it is still a drop.

Even in smaller markets, the number of equity listings has dropped dramatically — from India and the surrounding countries to the Middle East and North Africa to Russia and Central Asia to Sub-Saharan Africa. In fact, if you exclude the growth in equity listings in the Americas (not including the United States) and Asia Pacific, the decline in equity listings for all other regions averages 48%.

Number of Equity Listings (1975–2012)

What explains this mystery? Is it the decline in the number of initial public offerings? Could it be an increase in the number of corporate bankruptcies? How about an increase in the number of mergers and acquisitions taking equity listings off stock exchanges? Or perhaps the decline in stock listings is a result of the recent trend of businesses taking themselves private? Of course, the decline of equity listings could well be a combination of all of these factors.

One reason that has been put forward to explain the decline in the United States simply does not hold water. Namely, that onerous regulation has led to capital flight. If so, the data counter that claim, as listings are definitively down globally and in every region. In fact, the decline in public equities is unquestionable and should be a grave concern to both investors and policy makers alike.

Photo credit: ©iStockphoto.com/DNY59

Originally published on CFA Institute’s Enterprising Investor.