I strive to be smart, wise, analytical, creative, intuitive, and informative. I hope to help make you a better active investment management pro.

I recommend you start with the Best of the Blog.

Behavioral Finance – Bias Deep Dive: Loss Aversion

This begins a series of deep dive articles on the most important behavioral biases that we confront as investors. Now before you dismiss these articles with a cavalier “I already know this stuff,” I want to point out that much like Shakespeare, most people who quote behavioral finance and its bias precepts have never actually read the source material. My point in this series is to summarize the literature for you. Including the naysaying research which is almost never quoted. My ultimate goal is to have this series culminate in a Theory of...

read moreMBA Thinking Can Ruin Businesses

After more than three decades in the working world I can strongly state that MBA thinking can ruin a business. I say this as a proud MBA myself (go CU Buffs!). What leads me to say this? You Can Only Manage What You Can Measure is Bollocks Almost all graduate business school programs teach MBAs how to extract additional value out of existing businesses through management. Management of what? Generally speaking, the “numbers.” I have heard – and I bet that you have, too – numerous business leaders over the years tout, “You can only...

read moreWhy was the Equity Risk Premium Negative?

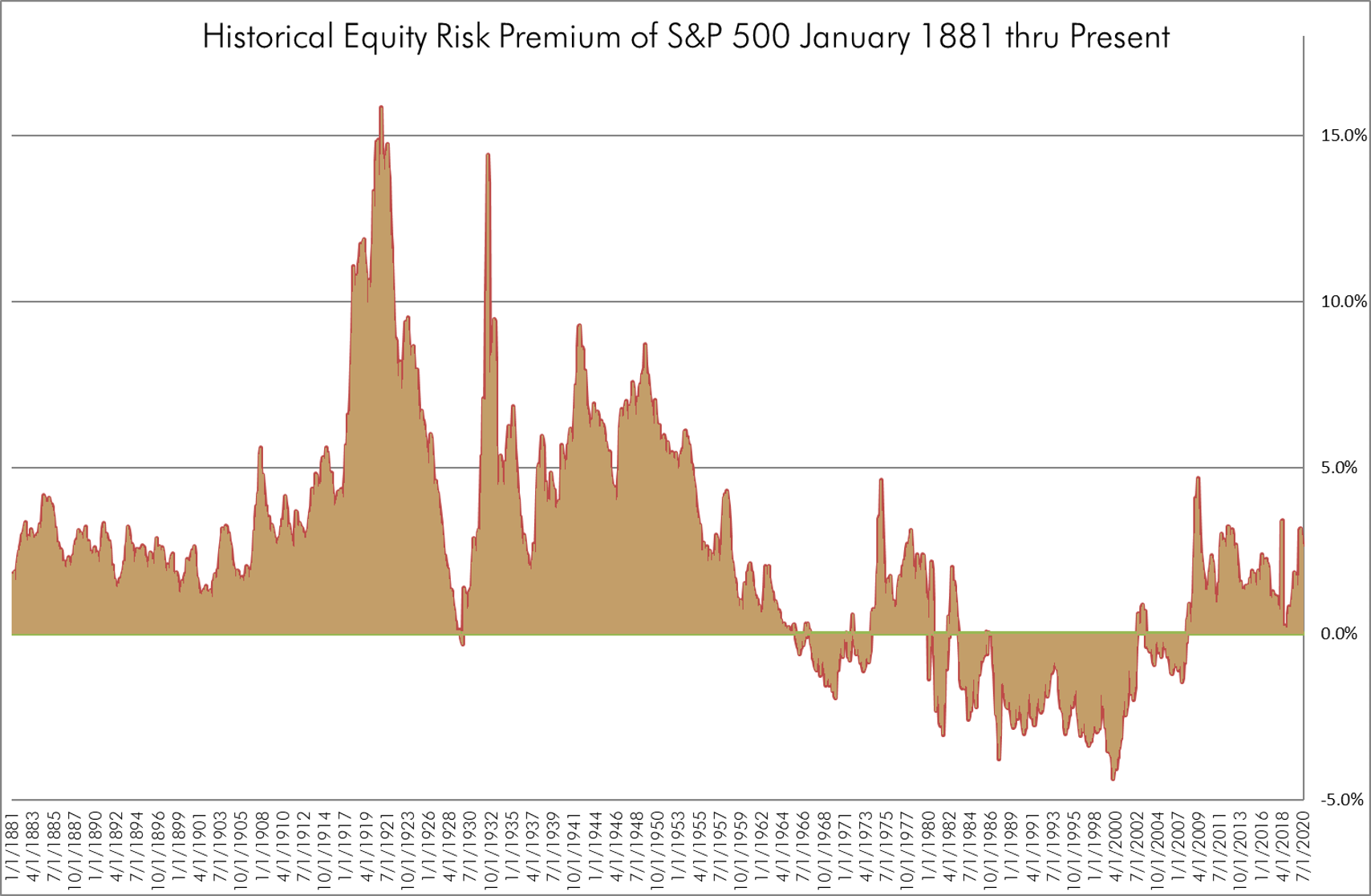

Last week I authored an article about the long history of the equity risk premium (January 1881 thru June 2020). A number of folks privately asked me why for a very extended period of time – what I called Epoch 3 – the equity risk premium was negative. That period of time was September 1966 thru December 2007 and the equity risk premium averaged -0.91%. Not only that, but it was negative a staggering 76.9% of the months for that 42.25 years! Put that in your pipe and smoke it. If we dive a bit deeper into Epoch 3 we see that it is interrupted...

read moreFrom the Research Chair Registration, Episode 3

From the Research Chair, Episode 003 is all about best practices surrounding portfolio construction, an arena in which most firms bleed alpha. Specifically, we will cover: What… 1. Portfolio Construction… what is it? 2. A useful metaphor – Building “a house from a bunch of bricks.” 3. How to find useful bricks. 4. How to select only the best bricks 5. Deciding on various sizes or positioning for strength. 6. Selling, or discarding the bricks “gone bad.”When…23 July 2020 at 12:00p EDT. Register...

read moreFact File: S&P 500 Equity Risk Premium History

Over the last month I have examined (what I think is) some of the most interesting data about the S&P 500. First up was the level volatility, which demonstrates that the market is not more efficient now than in decades past. Then I covered the history of the volume of the S&P 500; where we learned that almost 90% of the volume of this storied index has taken place in the last 20 years. More recently, I discussed the history of sigma events. Today I want to cover the history of the S&P 500 and its equity risk premium. Equity...

read moreFact File: S&P 500 Sigma Events, slight return

In keeping with the theme of recent weeks, I am doing a deeper dive into S&P 500 data. This week sees me updating an article originally published almost 8 years ago about the history of sigma events for the S&P 500. Or, as I like to call it the catalogue of, “People phreakin’ out.” From 3 January 1950 through 30 June 2020, the average daily return of the S&P 500 was 0.03%, and the standard deviation was 0.99% (source: AIM Consulting, LLC; Yahoo! Finance). Since my original post the average daily return of 3 basis...

read moreFrom the Research Chair, Episode 002 registration

Michael Falk, CFA, CRC and Jason A. Voss, CFA host From the Research Chair, a twice monthly show designed to help your team’s improve their investment philosophy, process, and execution. From the Research Chair, Episode 002 Features: Skills that Separate You as an Investment Manager: Curiosity. Something both Michael and Jason believe is a superpower. CURIOSITY topics covered include: 1. Why curiosity is important to investment pros. 2. The science of curiosity. 3. How to cultivate it for yourself. When: 9 July 2020 at 10:30a to 11:30a...

read moreFact File: S&P 500 Volume Data, slight return

Over eight years ago I published an article about the S&P 500 and its volume data. With apologies to Jimi Hendrix and Voodoo Chile, this is my slight return to the subject. We have just 7 months left in the 2010s, but we are close enough for an update. Sources: Yahoo! Finance; AIM Consulting, LLC Contact me so that I can help your investment firm. I make my living as a consultant, not as a writer. My job is to help you and your investment team get better. The Take-Aways… The busiest trading day ever for the S&P 500...

read moreFrom the Research Chair – Episode 001

Our new podcast…From the Research Chair, Episode 001. Featuring me and Michael Falk. In it we discuss our view of the future of #investmentmanagement. Best of all it was lots of fun. Watch this space for all future episodes. Share widely...

read moreFact File: S&P 500 Level Volatility…is the Market Efficient?

Forgive me for referring to the S&P 500 as analogous to “the market” in my headline. This is one of my pet peeves, because the Market is a much broader thing than one broad-based stock index. It is really every investable asset, in my opinion. However, I recognize that many people, when thinking about the S&P 500, take it as a proxy for “the market.” Blah, blah, let me get on with it. A Common Fiction: the market is getting more efficient There is a riff and refrain in the investment management industry that “the market” is...

read more